Buying a New Build: Spec Home, Custom or Production – What’s Right for You?

You’ve weighed the pros and cons from pricing and customization to location and home maintenance and decided that a new home is a better fit for you than purchasing an existing home. But what type of new home is the right choice for you? Learn the differences here.

Homeowners Have Missed Out on Billions in Refinance Savings – Is It Too Late for You?

American homeowners could have saved a combined $5.5 billion by refinancing their mortgages in 2010 and 2012, according to a new study published in the Journal of Financial Economics. Despite historically low mortgage rates, homeowners didn’t make refinancing a top priority, which prompts the question: with mortgage rates rising in 2017, is it too late […]

Buying vs. Renting: Doing the Math on What’s Best for You

In 2014, 11 million renters were spending at least half of their income on housing, according to Harvard’s Joint Center for Housing Studies. Another 21.3 million (over 50 percent of renters) were spending 30 percent or more of their income on rent payments. So in an era where rent costs are going up, up, up, how […]

Why Location Matters & How to Scout Out the Best Spot When Buying Your First Home

“Location, location, location” wouldn’t be the catchphrase of the real estate industry if it weren’t true. It happens to be right: You can change a home, but you cannot change its location. Here’s why location matters when it comes to buying a home, and here’s how to scout out the best neighborhood in which to […]

5 Preparation Steps to Move From Renting to Owning

If you’re thinking of purchasing a home in the near future because of high rent, you’re not alone. A few years ago, one in four homebuyers was looking to purchase a home because of the high cost of rent, according to Redfin. Homeownership is a big decision, so whether you plan to buy soon or […]

Mortgage 101: What Goes Into a Mortgage Payment?

Understanding what is included in your monthly mortgage payment is as easy as remembering five letters: P, I, T, I, A. The mortgage industry uses the acronym, PITIA—Principal, Interest, Taxes, Insurance and homeowner’s Association fees—to break down the components of a homeowner’s monthly payment.

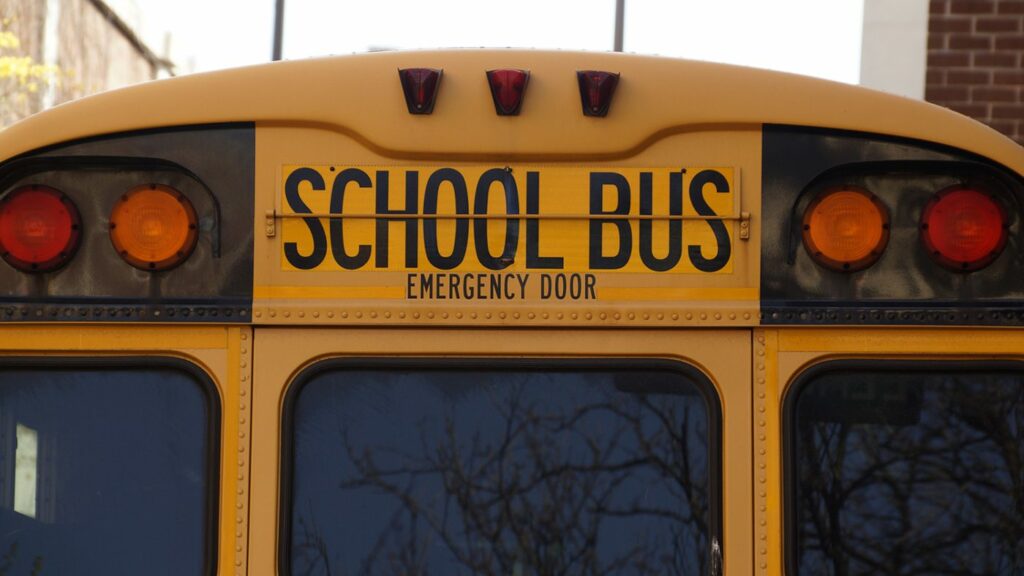

Back to School! Home Values 77 Percent Higher in Zip Codes With Good Schools Than Those Without

A home within a great school district has always been a good selling point, but now a new study performed by ATTOM Data Solutions shows just how big the impact of high-performing education is on home values.

Mortgage 101: 7 Things NOT to Do After Applying for a Mortgage

At this point, you probably know the list of things to do and not to do before applying for a mortgage. There are also certain actions involving your credit, finances and employment which can affect your credit score and which should wait until after closing on your mortgage. Avoid making the following seven mistakes between […]

Homebuying 101: How to Determine Which Home Type Is Right for You

Determining what type of housing is right for you can prove to be a difficult task when you consider what you need now along with future contingencies including job promotions, budget fluctuations, out-of-state relocation, marriage, the birth of a child, costs of education and so on. It is very important both to choose the type […]

9 Lawn Care, Landscaping & Gardening Do’s and Don’ts for the First-Time Homeowner

Owning your first home can be overwhelming as you adjust to the new responsibilities and tasks of homeownership. While you’re busy turning the interior of your house into your own home, don’t neglect the view of from the curb. Here are some beginner’s tips for making wise and budget-friendly choices when it comes to your […]